Intellicast S4E22 – Combining First and Third-Party Data and MRX News

July 1, 2021

Positive WFH Stories

July 8, 2021When it comes to getting high-quality survey data, respondent experience is extremely important. Factors such as survey design, accessibility, and incentives affect a respondent’s overall experience, and this can have a real impact on your data.

In our latest wave of research-on-research, we asked respondents what incentive they were offered to participate in our survey. Options included cash, points to redeem, gift cards, and more. We analyzed this to understand how it impacted their brand awareness and ratings, as well as other attitudes and behaviors and their overall survey experience.

Brand Awareness

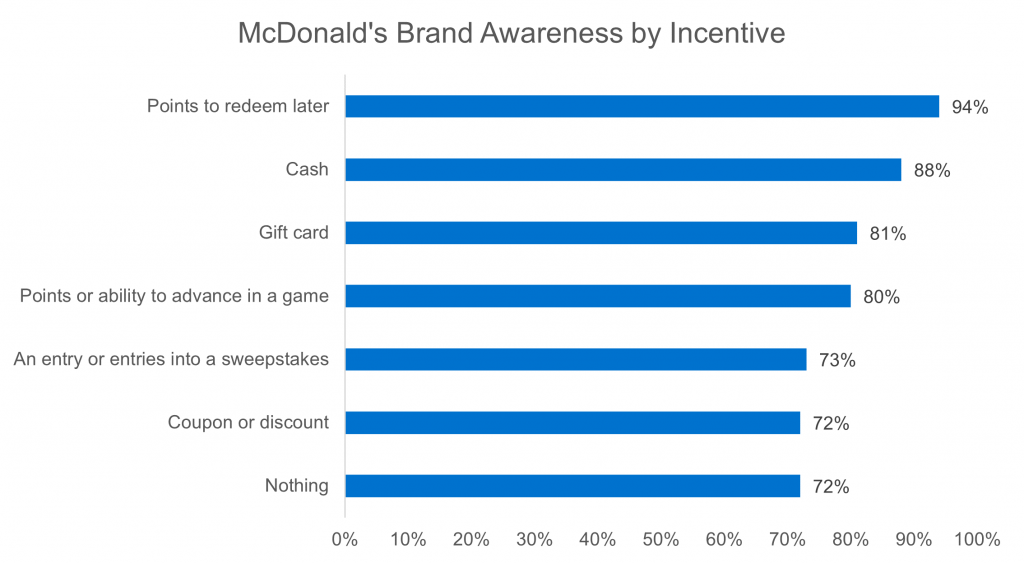

Respondents were asked about their awareness of several brands, and the results were segmented by what incentive respondents were offered. There appear to be variations in brand awareness based on how the respondent was incentivized to take the survey; for example, brand awareness for Coke was highest among those who were offered points to redeem later, followed by those who were offered cash. The lowest average brand awareness for Coke was seen among those who were offered a coupon/discount or an entry into a sweepstakes; respondents with these incentives actually had lower brand awareness than those who were offered nothing to participate in the survey.

Similar results can be seen for the brand awareness of McDonald’s. Awareness was again highest among respondents who received points to redeem later at 94%, followed by those who received cash at 88%. The lowest brand awareness for McDonald’s was seen among respondents who either received nothing or received a coupon/discount for taking the survey.

Brand Ratings

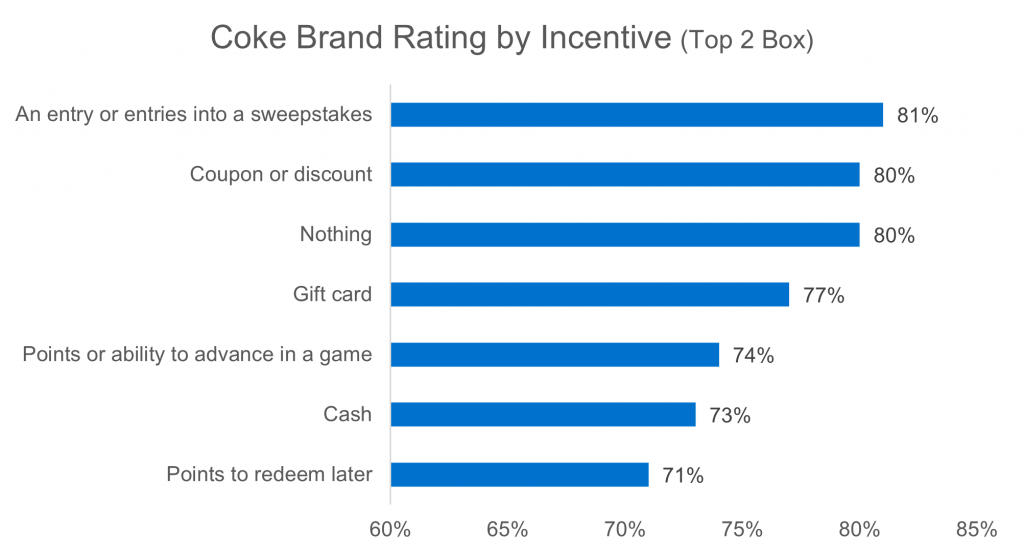

Respondents were also asked to rate the brands they are aware of on a 5-point scale. Looking at the top 2 box for Coke brand ratings grouped by incentive, we can see that there is up to a 10% difference in ratings among respondent groups based on how they were incentivized to take the survey. Those earning an entry into a sweepstakes, a coupon or discount, or nothing for their participation tend to rate the brand the highest, whereas those earning points to redeem later had the lowest ratings on average. These results are the opposite from what we saw with brand awareness– in other words, respondents earning points to redeem later as their incentive had the highest Coke brand awareness, but the lowest Coke brand ratings on average.

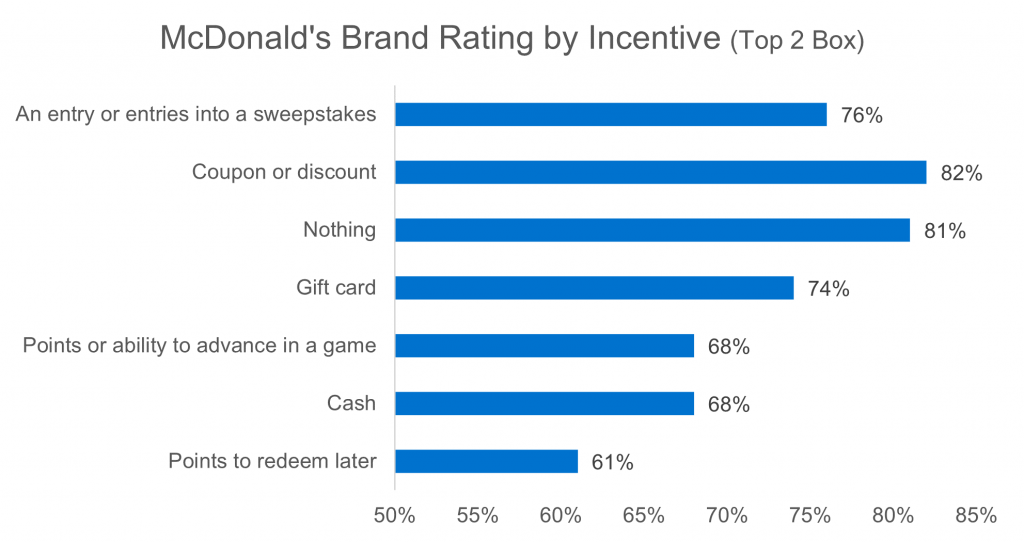

For McDonald’s, the results are somewhat similar, with brand ratings being the highest among those earning either a coupon/discount or nothing as their incentive to take the survey. Brand ratings were lowest among those earning points to redeem later at only 61%, which is a 21% difference from the highest rating group.

Other Attitudes and Behaviors

There also seems to be differences among incentive groups for various attitudes and behaviors. For example, respondents were asked whether they smoke cigarettes, and up to a 21% difference was seen in the proportion who smoked depending on their incentive. Those who were earning a coupon or discount were the most likely to smoke cigarettes at 45%, and those earning points to redeem later were the least likely at 24%.

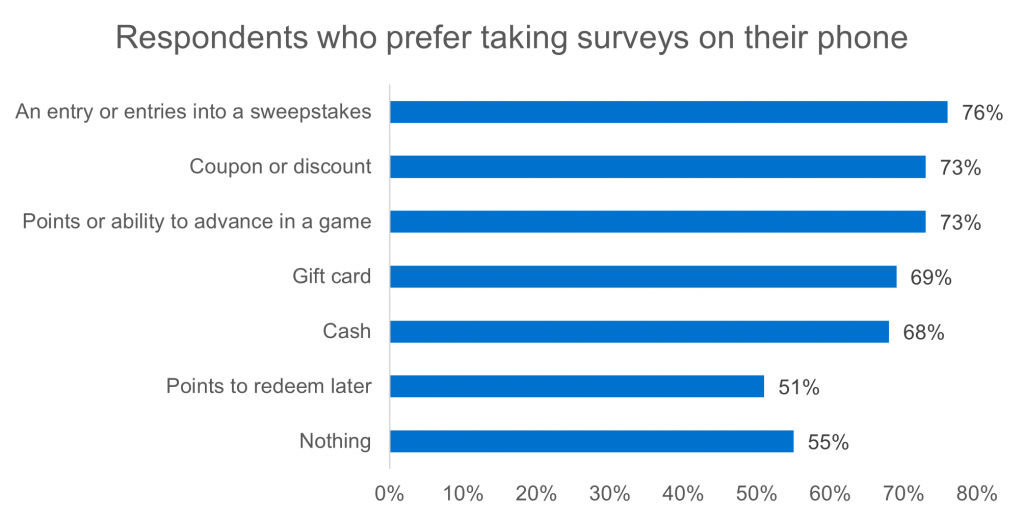

When asked whether they prefer taking surveys on their phone, respondents displayed up to a 25% difference in response depending on their incentive. Those earning an entry into a sweepstakes were the most likely to prefer taking surveys on their phone, followed by those earning a coupon/discount and those earning points/advancements in a game. Those earning points to redeem later were the least likely to prefer taking surveys on their phone at only 51%.

There are many factors that play into how a panel and its respondents are managed, one of these critical factors being incentives. They can have a real impact on your data, specifically brand awareness and ratings. This is why it is so important to understand how panels are managed and why we recommend a blended approach to sample. Check out these recent blogs and resources on panel management and data quality:

How Sample Providers Manage Their Panels? The 25 You Should Know

What You Need to Know About How Sample Providers Manage Their Panels