Intellicast Episode 26: Market Research News And More

August 10, 2018

Intellicast Episode 27: Dr. Aron Levin of Northern Kentucky University

August 20, 2018In this installment of The Sample Landscape, we will discuss activities that respondents are willing to participate in among consumer samples and B2B samples. As part of our ongoing research of the sample industry, we routinely ask question surrounding respondent satisfaction with the survey-taking experience and subsequently evaluate this data by sample provider to help differentiate between options.

Consumers and Privacy

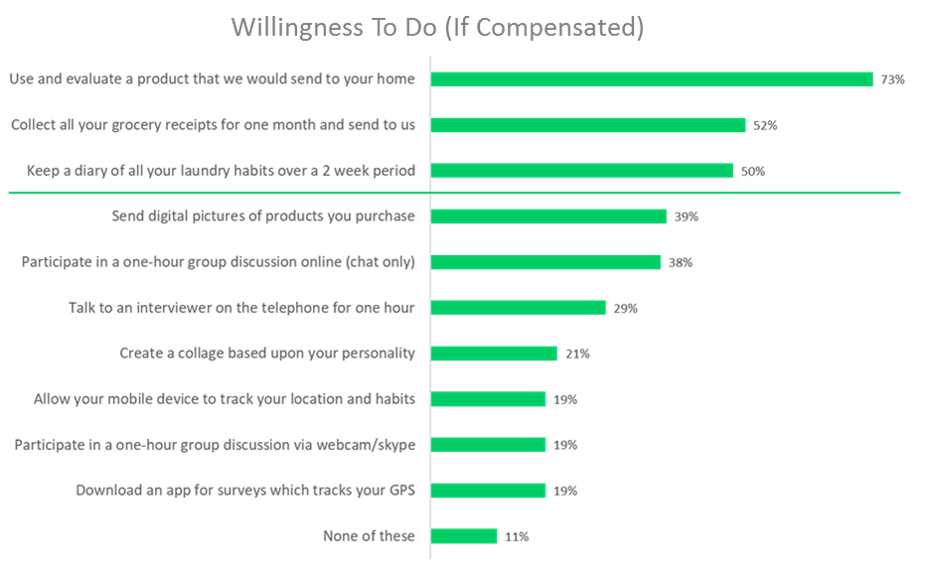

In one survey that we fielded, respondents were asked, “Which of the following would you be willing to do if adequately compensated?” We found that respondents are not willing to do very much…even for more money! The mentality of the “personal bubble” is alive and well in these findings.

Respondents are mostly willing to participate in activities that do not interfere with day-to-day responsibilities and that do not invade personal boundaries. Some of these activities included using and evaluating products sent to their homes, collect and send grocery receipts, and keep a laundry diary.

There was a significant drop off when asked if they would be willing to send digital pictures of products purchased. Only 39% of respondents were willing to do this. Other activities that respondents were less willing to participate in included downloading an app for surveys which tracks your GPS, participate in a one-hour group discussion via webcam, and allow their mobile device to track location and habit.

B2B And Anonymity

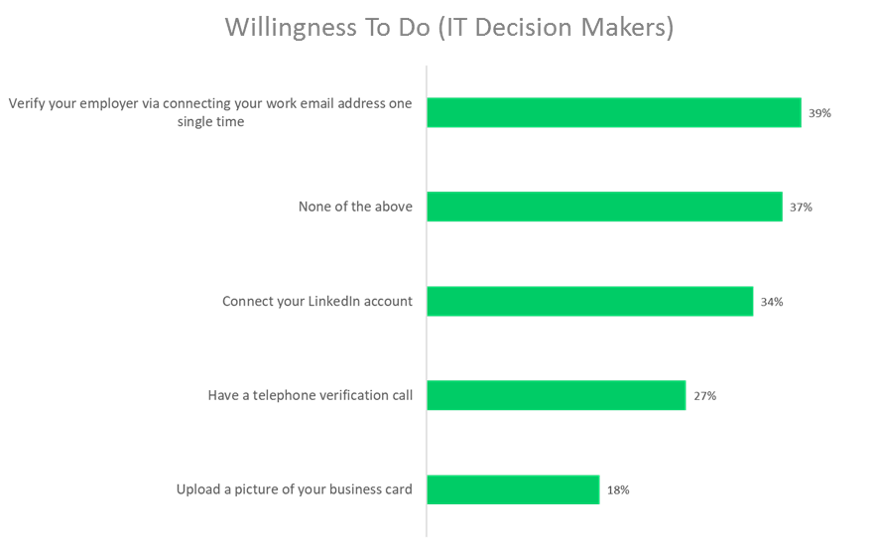

In a different survey, we asked IT decision makers what they would be willing to do. We were surprised to find that less than 4 out of 10 respondents were willing to do anything. Only 39% of respondents were willing to verify their employer via connecting their work email address one single time. A large chunk of respondents (37%) weren’t willing to do anything.

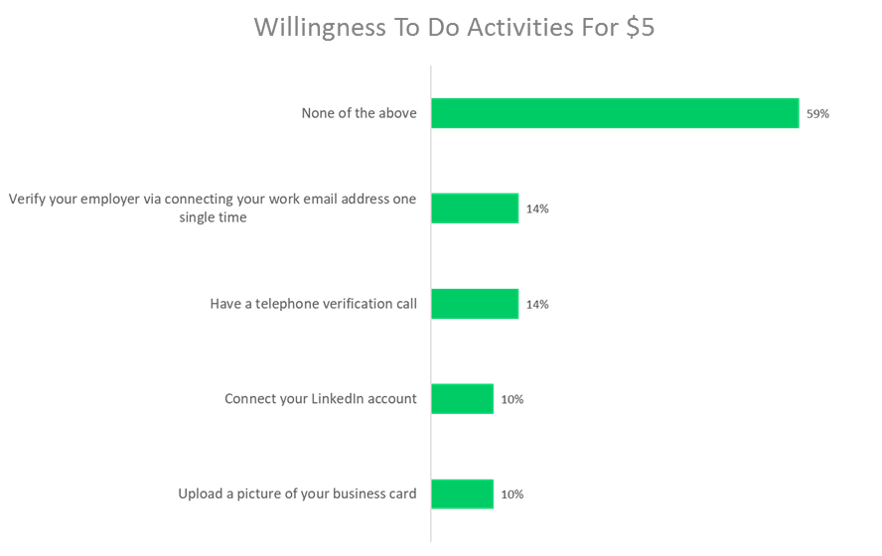

We then asked anyone who responded “None of the above” if they would be willing to do these activities for $5. A staggering majority of 59% stuck to their guns and still responded “None of the above.”

Implications

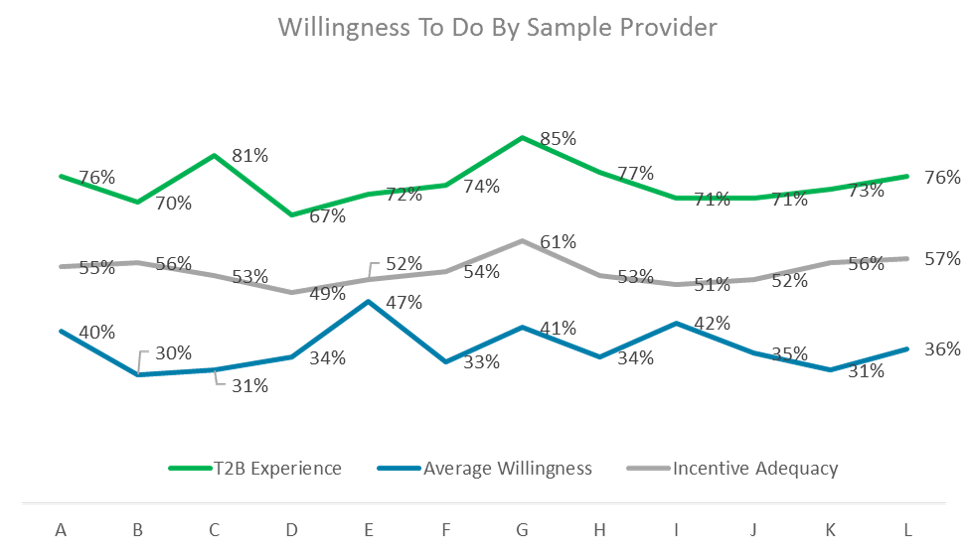

One question we wanted to answer when we started to look at the data was whether or not willingness to participate in an activity varies by partner. We discussed in a previous blog that overall experience and incentive adequacy varies by partner. Wouldn’t willingness also vary? We also thought that willingness may be correlated with overall experience and incentive adequacy.

Willingness to do things does, in fact, vary by vendor, but there is little relationship between general experience and willingness. Even the highest rated vendor (81%) has an average willingness of 31%.

The pressing question here is, why are these scores so low across the board? It is not because of poor survey experience or inadequate incentive. It is likely that a lack of trust and a concern over privacy can be attributed to the low willingness scores.

When asked about concern related to privacy, 95% of respondents were at least somewhat concerned. This is likely a factor in the low willingness scores which is understandable! Respondents don’t know who the people behind the survey are. We are just random people without faces to them. For respondents to be willing to share more information, it is important to ensure that their personal information will be kept private and won’t be shared. Transparency is key.

To read the first installment of The Sample Landscape where we talk about overall experience, click here.

To read the previous installment about respondent device usage across the sample industry, click here.

To discover how EMI can help you with your next survey project, request a free consultation.