Intellicast S6E6 – Schlesinger or Should We Say Sago

March 3, 2023

Intellicast S6E7– Connecting Marketing with the Frontline with Chris Wallace of InnerView

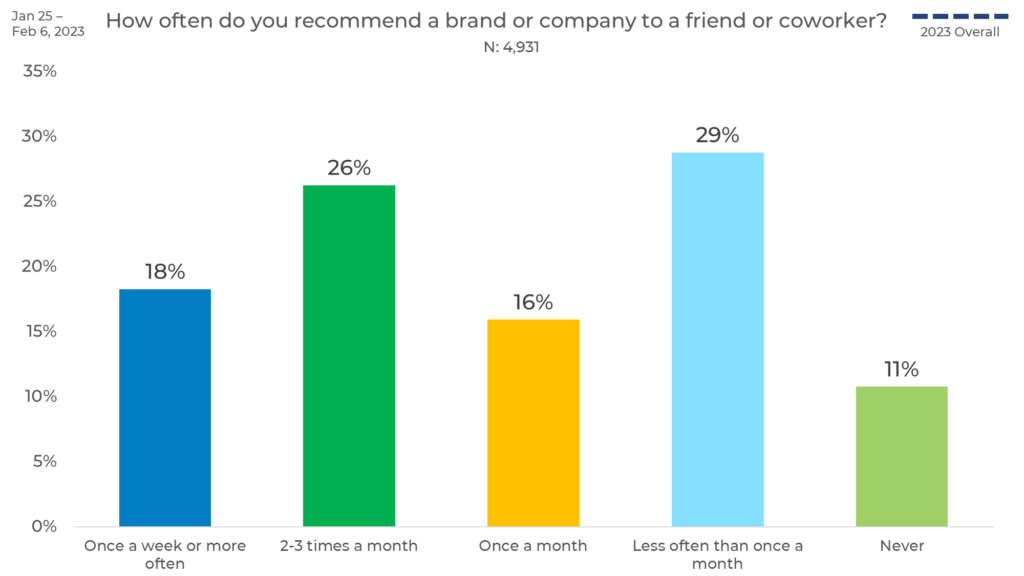

March 14, 2023Since we are in market research, we see a lot of surveys. But we’re willing to bet you see a lot of surveys too. Specifically, NPS surveys. These days it seems like after every transaction or visit we make, an NPS survey follows. How’d we do? Would you like to rate your experience? How likely are you to refer us to a friend? NPS surveys are a great way to measure customer loyalty, but how often do we actually recommend brands or companies to our friends? We found out in our latest round of research-on-research.

Overall, people are most likely to refer brands or companies to a friend less than once a month. This is closely followed by people who refer a brand or company to a friend 2-3 times a month.

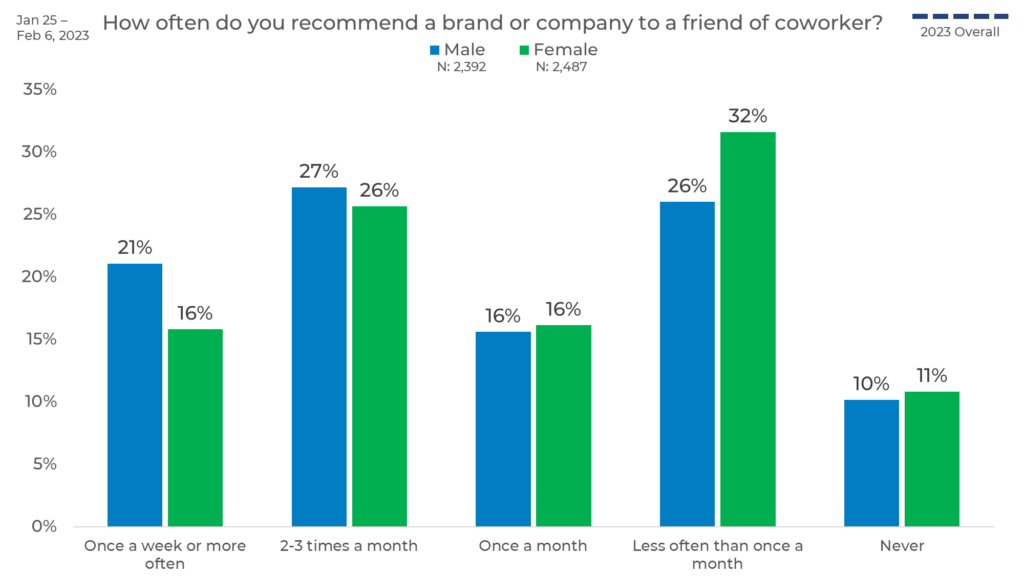

Gender

When comparing response by gender, we see that males are more likely than females to refer companies or brands more often (once a week or more and 2-3 times a month.) Females are more likely to refer friends to brands or companies less than once a month.

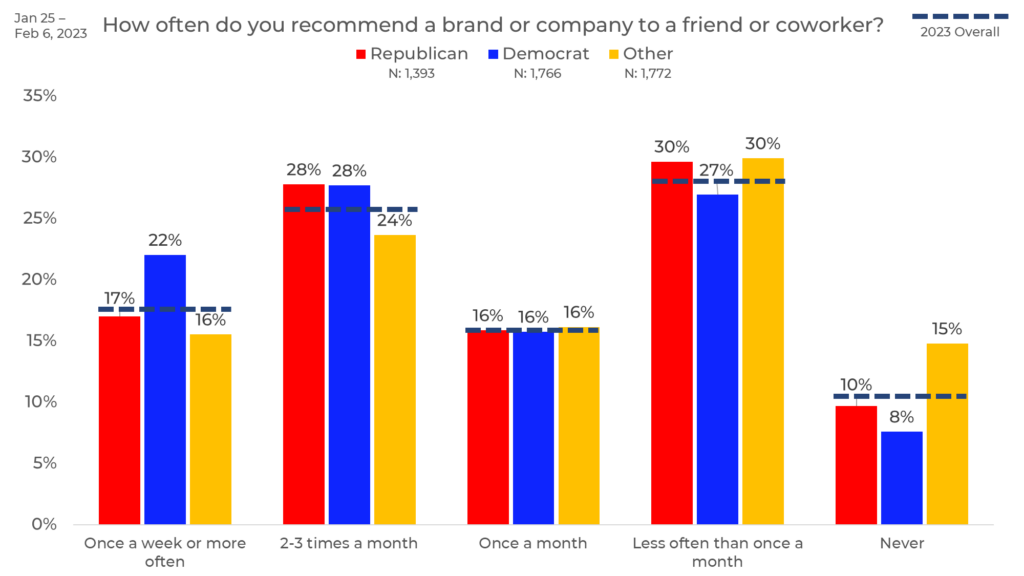

Political Affiliation

When it comes to political affiliation, we find that Democrats are the most likely to recommend brands or companies more often, with 22% recommending once a week or more often. Those who identify with political parties other than Republican or Democrat are least likely to recommend brands and companies with 15% saying they never refer to friends or family.

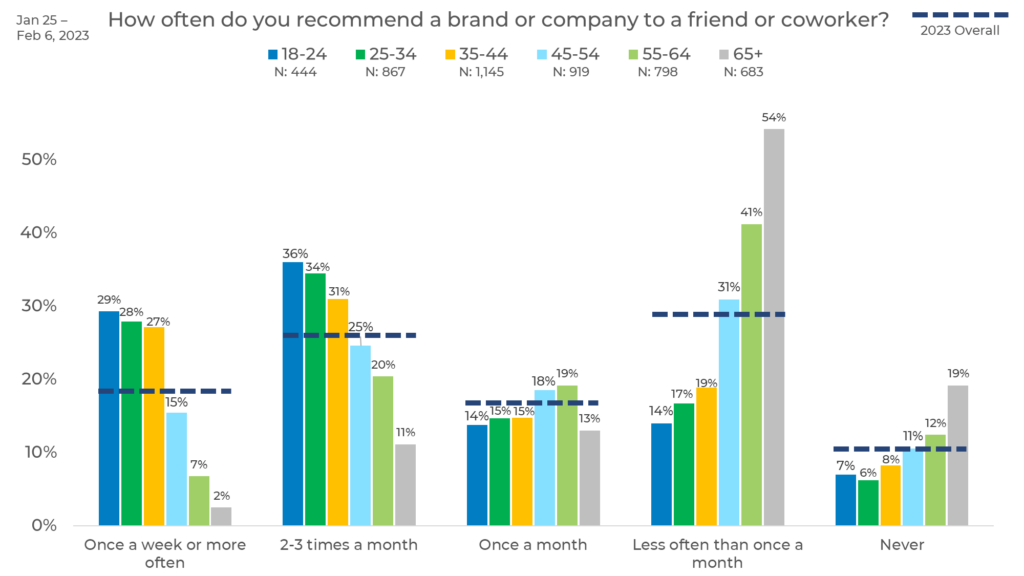

Age

We also analyzed response by age. Here we see that the older a person is, the less likely they are to recommend brands and companies. People aged 65+ are 25% more likely than the overall average to say they recommend brands or companies to their friends and family less than once a month. Younger people are more likely to recommend a brand or company once a week or more (11% more likely than the overall average.)

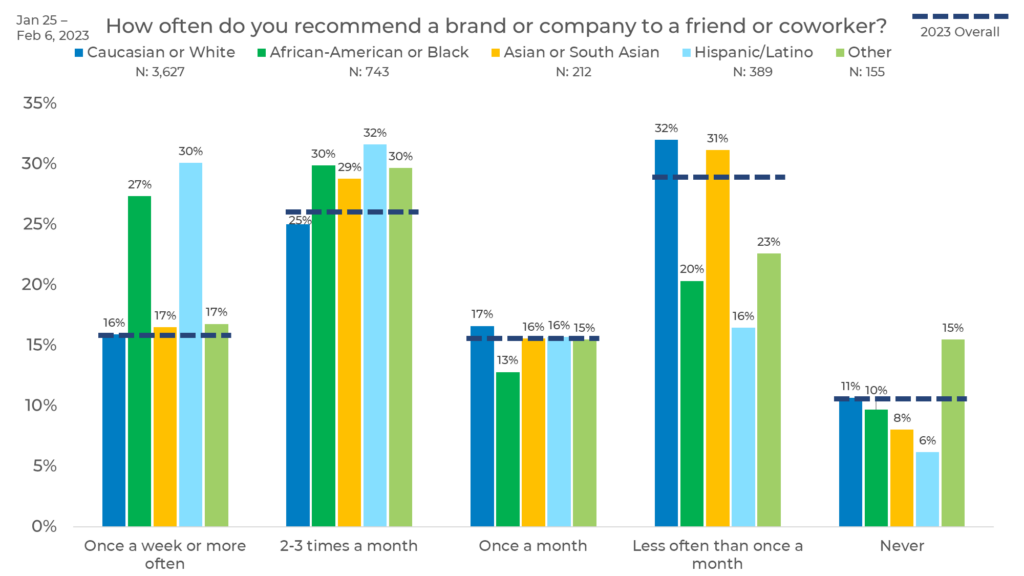

Ethnicity

Looking at ethnicity, we see that Hispanic/Latino and African American or Black respondents are most likely to recommend a brand or company to friends with 30% and 27% saying they recommend once a week or more, respectively. Hispanic/Latino respondents are 12% more likely than the overall average to recommend once a week or more. Caucasian or White and Asian or South Asian respondents are least likely to recommend brands or companies to their friends with 32% and 31% saying they recommend less than once a month, respectively.

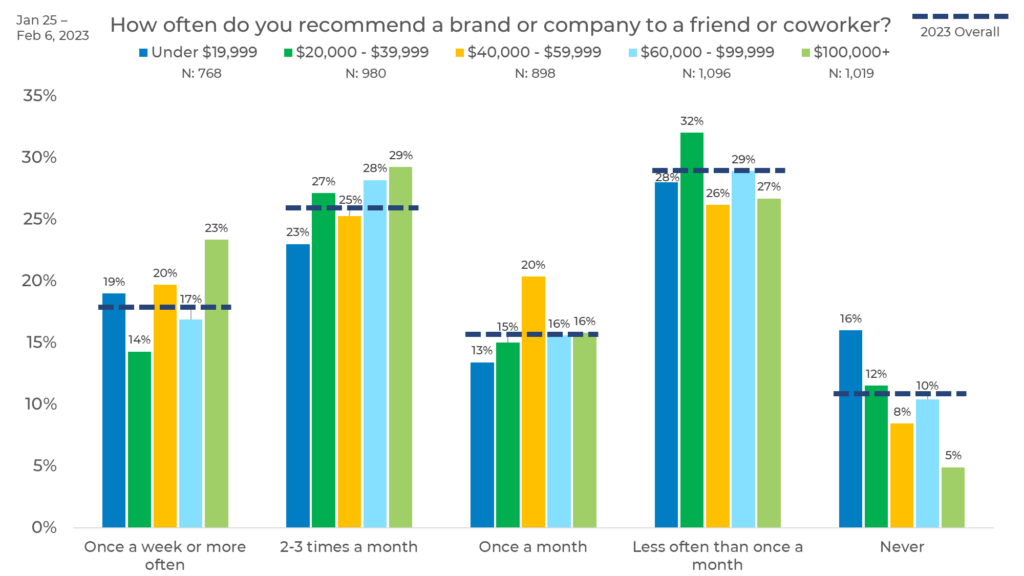

Income

When comparing responses by income, we see that those with incomes of $100,000+ are most likely to recommend a brand or company once a week or more at 23% (5% higher than the overall average.) Those with incomes under $19,999 are most likely to say they never recommend brands or companies to their friends at 16% (5% higher than the overall average.)

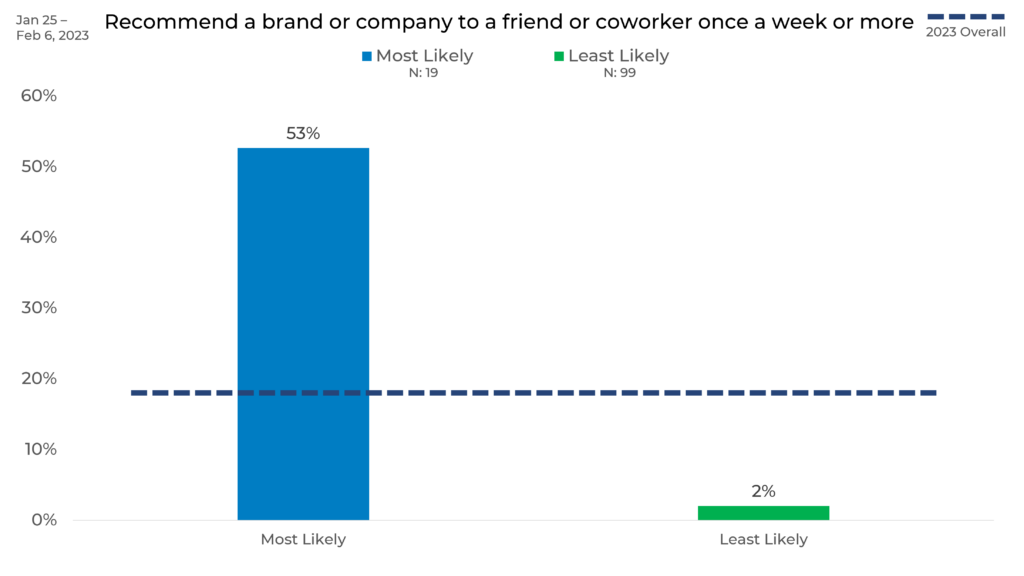

So, Who’s the Most Likely to Recommend? Who’s Least Likely?

When we look at this data as a whole, we find that a male Democrat below the age of 35 with a salary about $75k and who is Hispanic/Latino or Black/African American is the most likely to recommend a brand or company to a friend. A Caucasian female above the age of 50 with a salary below $40k and who does not identify as either Democrat or Republican is the least likely to recommend a brand or company.

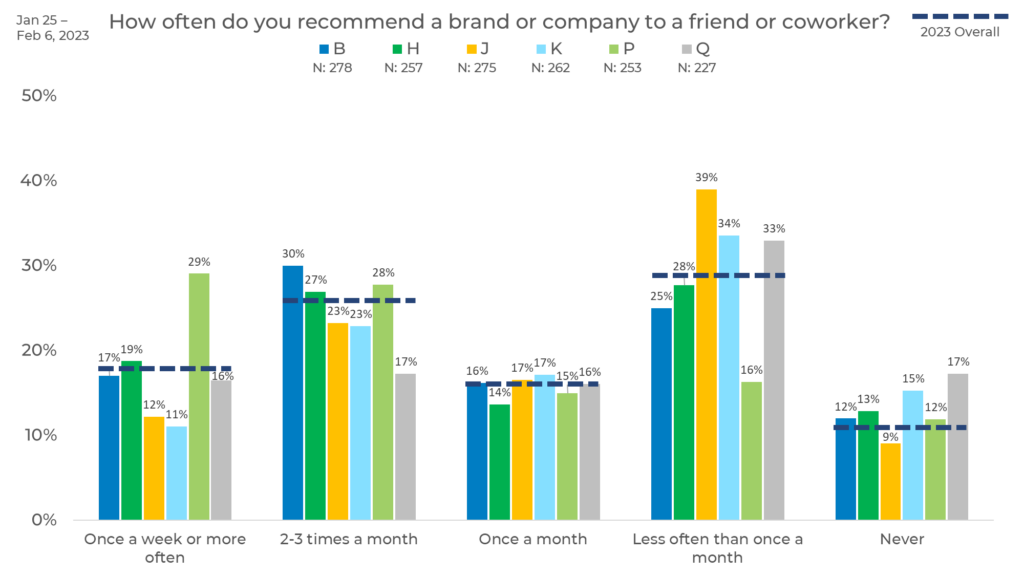

Panel

Finally, we looked at response by panel. Here, we see differences up to 23 percentage points by panel as shown between panels J and P in those who recommend brands or companies to their friends or coworkers less than once a month. We also see variances up to 11 points higher and 13 points lower than the overall average. This can be due to differences in panel makeup, management, and more.

As we see in this blog, consumer behavior data varies greatly by both demographic and panel which can have a significant impact on your research. For instance, if you only used Panel P for your study, you might think people are recommending your brand more often than they actually are. This is why strategic sample blending is the best practice to ensure any changes in your data are due to shifts in the market, not inconsistencies in your sample.