Intellicast S6E28 – A Look at AI in Market Research

November 10, 2023

Hitting the Store or Hitting the Couch: 2023 Trends in Black Friday Shopping

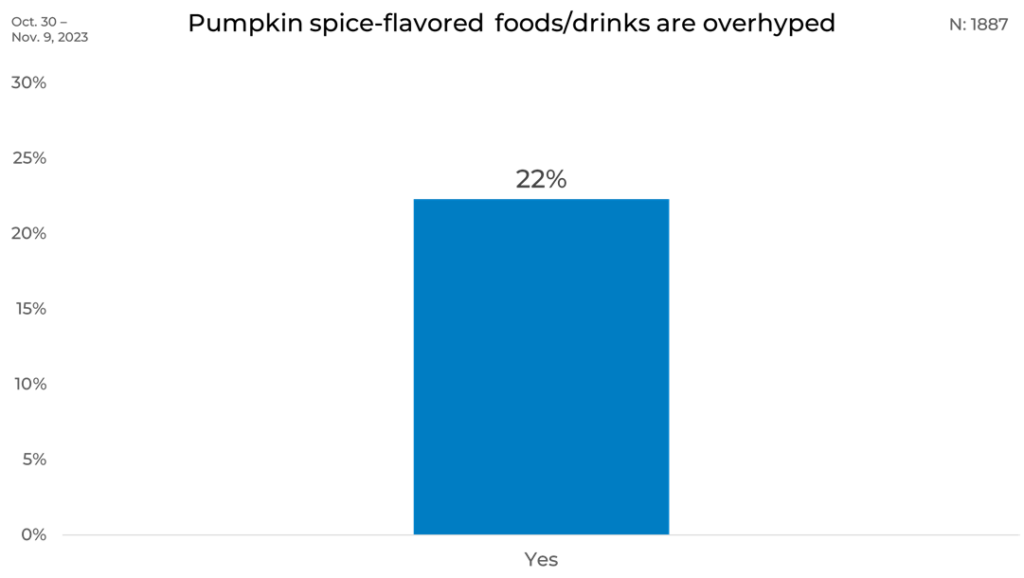

November 17, 2023In our quest to explore the realm of seasonal tastes, we recently posed a question in our latest round of research-on-research that’s as much a part of fall as the changing leaves: Are pumpkin spice flavored foods and drinks overrated? From the tail end of October to the brisk beginning of November, we surveyed 1,887 people to get a taste of public opinion.

The results are in, and it turns out that the pumpkin spice trend might not be as tired or overwhelming as some coffee shop menus would have us believe. Only 22% of our respondents feel that pumpkin spice products are overhyped. This tells us that despite a vocal few who might be weary of this autumnal trend, the majority are still enjoying their seasonal spice with gusto. It seems that, at least for now, pumpkin spice still has a seat at the fall festivities table.

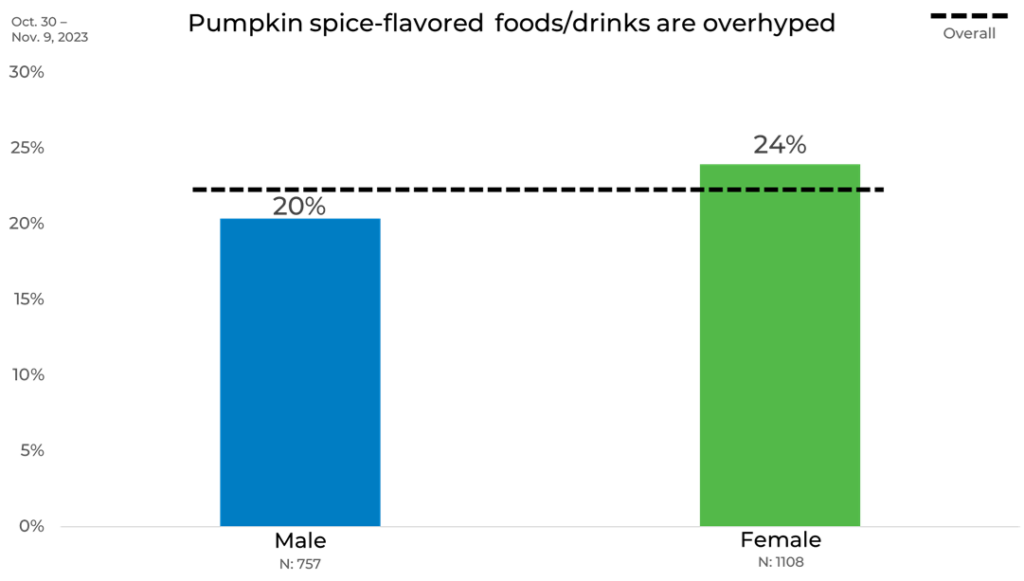

Gender

In the discussion around pumpkin spice, a pattern emerges when we separate the responses by gender. The survey reveals that 24% of females are of the opinion that pumpkin spice flavored foods and drinks are overhyped, which is slightly higher than the 20% of males who share this sentiment. It seems that females might be leading the wave of those who think the pumpkin spice trend could use a little dialing back.

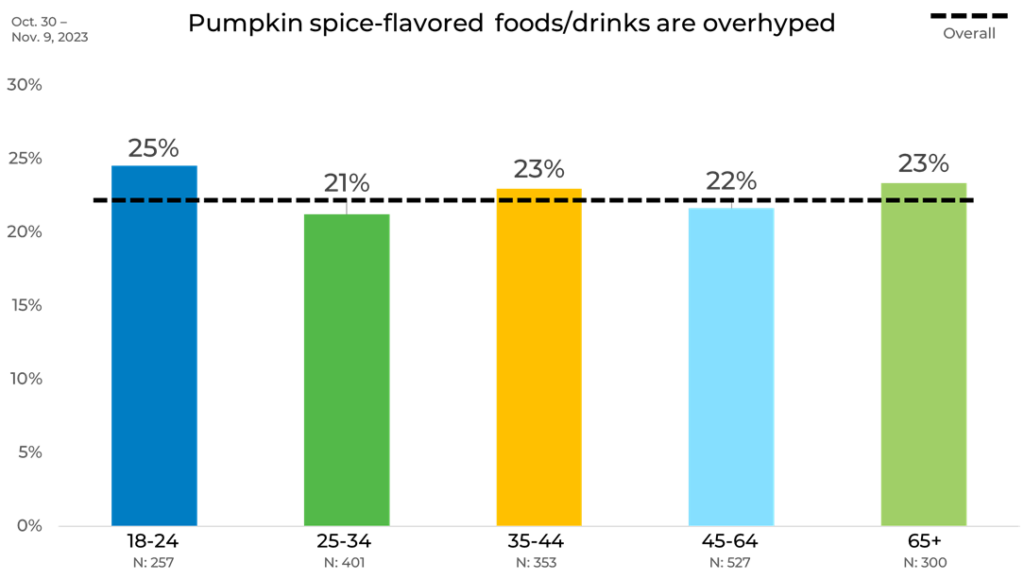

Age

Looking at the feelings towards pumpkin spice through the lens of age presents a relatively consistent picture with a slight tilt. The youngest group, those aged 18-24, are the most likely to view pumpkin spice as overdone, with 25% believing it’s overrated. This sentiment tapers off slightly as we move up the age categories, but only by a small margin, with the oldest group at 23% and all other age ranges hovering close to the overall average of 22%. The modest 4% variance from youngest to oldest suggests that pumpkin spice’s appeal – or its perceived overhype – is not hugely polarizing across generations.

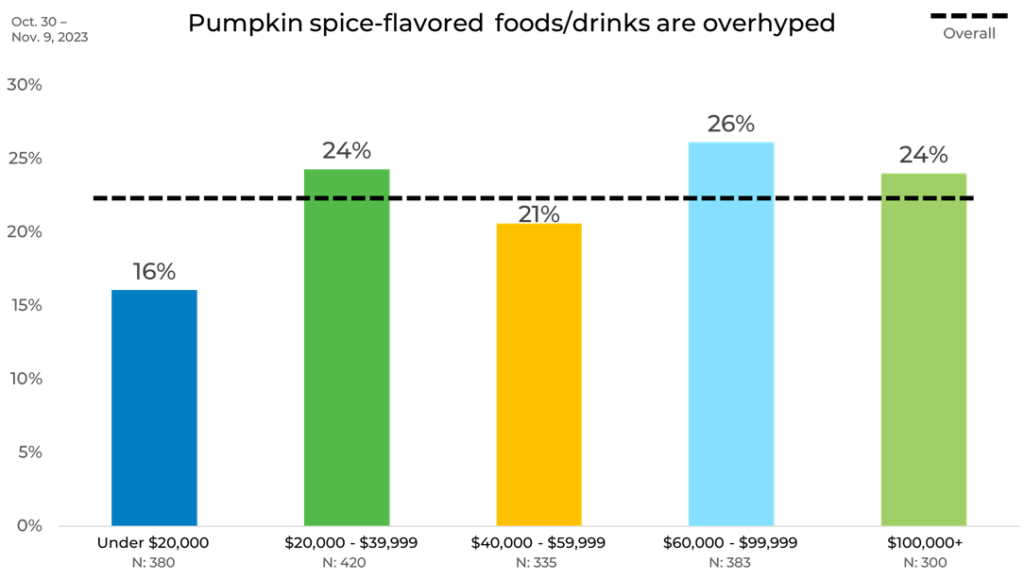

Income

We also found that opinions on pumpkin spice also varied with income levels. Individuals earning under $20,000 annually are the least likely to consider pumpkin spice flavors as overrated, with only 16% agreeing with the sentiment. In contrast, those with incomes between $60,000 and $99,999 are the most likely to think so, at 26%. This 10% gap suggests that perceptions of pumpkin spice’s merit may shift with economic standing, possibly reflecting a difference in spending priorities or exposure to the marketing of seasonal products across different income brackets.

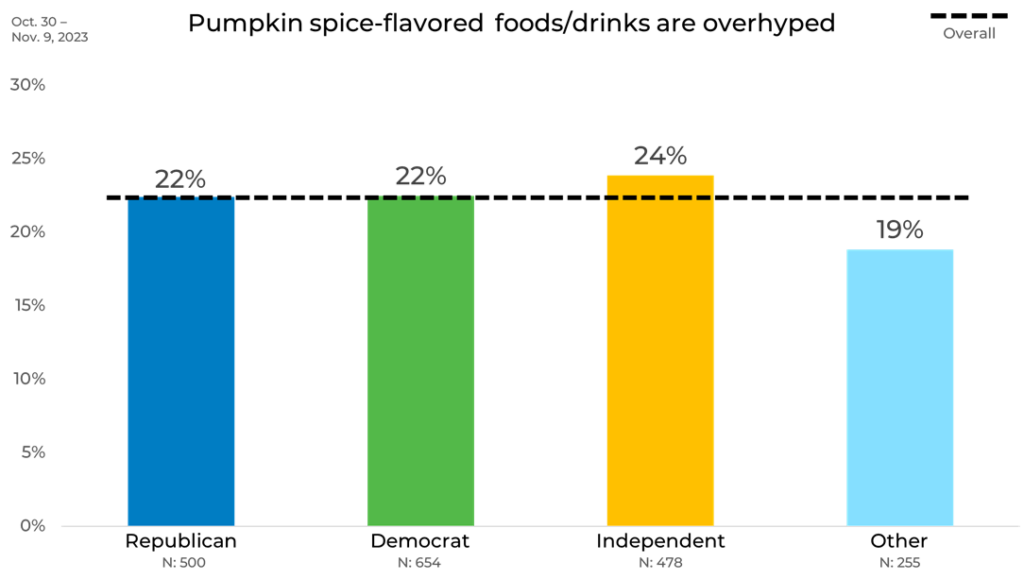

Political Affiliation

We took an unexpected turn when we examined the data through the lens of political affiliation. Surprisingly, it’s those who identify as politically independent who are most inclined to view pumpkin spice flavored foods and drinks as overrated, with 24% in agreement. Interestingly, both Democrats and Republicans finally agree on something, with each having 22% saying that pumpkin spice is overhyped.

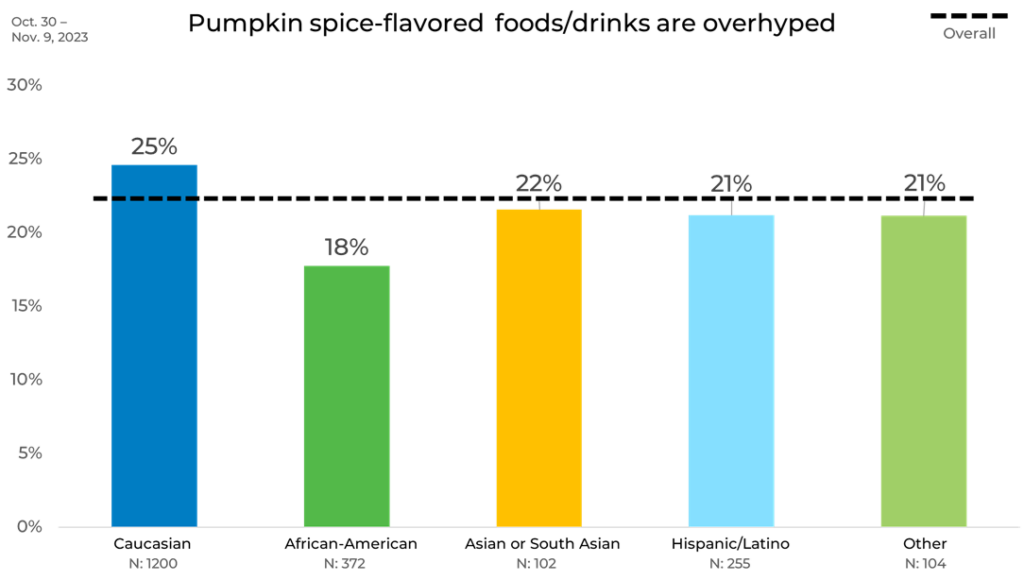

Ethnicity

The survey also shed light on opinions about pumpkin spice across different ethnicities. Caucasian participants are the most likely to find pumpkin spice overrated, with 25% in agreement. In contrast, African American respondents show more enthusiasm for the flavor, with only 18% considering it overrated, marking a 7% lower rate than their Caucasian counterparts. For Asian or South Asian and Hispanic/Latino groups, the sentiment sits around the survey’s overall average.

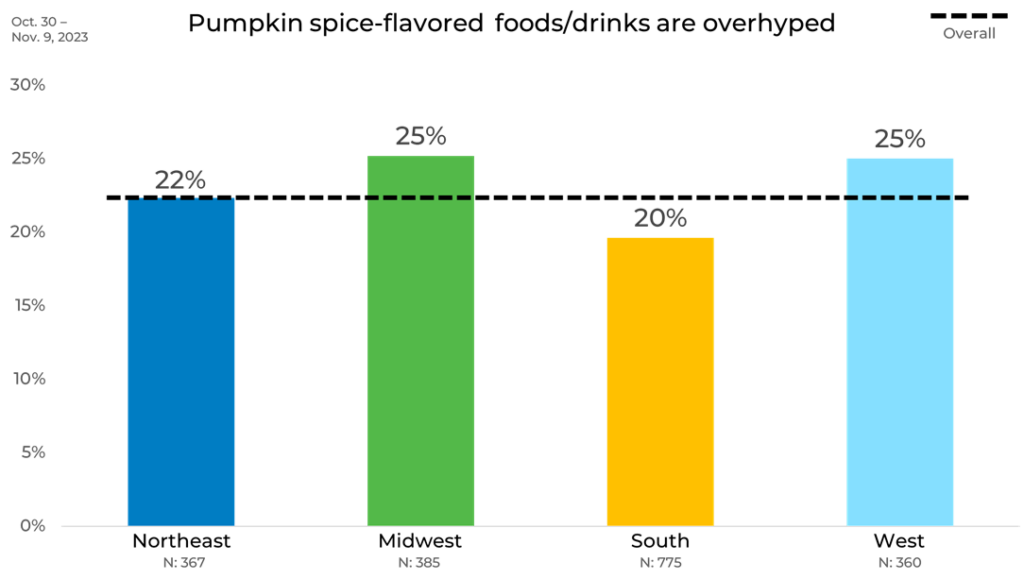

Region

The regional take on the pumpkin spice debate adds a new layer of flavor to our findings. In the heartland and on the West Coast, there’s a shared sentiment; both the Midwest and the West reported a 25% agreement that pumpkin spice is overhyped. This is a notable 5% increase over the opinions from the South, where only 20% felt the seasonal trend was overdone. The variety in these perspectives might just be a reflection of regional tastes or perhaps the different ways each area welcomes the fall season.

Panel

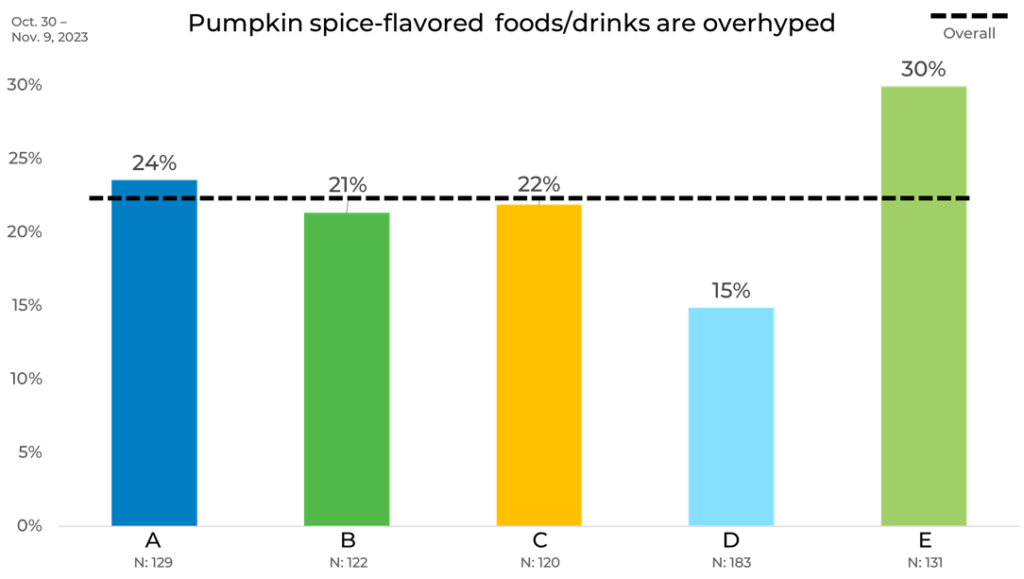

When we examine the data by panel, the distinction between Panel E and Panel D is particularly striking. Panel E stands out with a substantial 30% of its participants considering pumpkin spice flavored foods and drinks as overhyped, which is significantly higher compared to other panels. This is in sharp contrast to Panel D, where only 15% share this sentiment, marking the lowest amongst all groups. This 15% gap between Panels E and D is the largest observed difference in the survey, underscoring a remarkable divergence in opinion on the pumpkin spice trend between these two specific groups.

As you can see, attitudes and behaviors can vary greatly by both demographic and panel. This can have a significant impact on your data. For instance, if someone only used Panel E for their research around beverage flavors, they could get inflated negative results. If Panel D was only used, they would get inflated positive results. This is why strategic sample blending is the best practice to ensure any changes in your data are due to shifts in the market, not any biases individual panels may have.

Learn more about panel differences in our annual report on the sample industry, The Sample Landscape: 2023 Edition.