Rising Prices, Rising Tensions: Why Economic Satisfaction Still Splits the Nation

November 17, 2025

The “No Sh*t, Sherlock” Episode

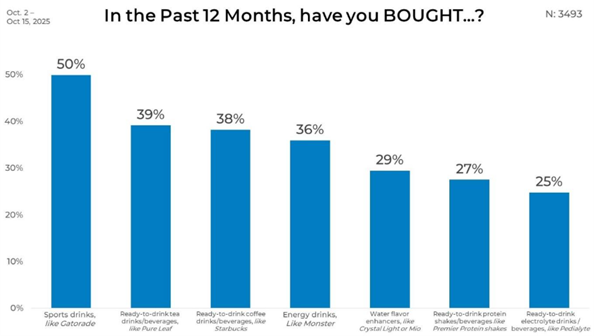

November 25, 2025It seems like the selection of beverages available to consumers has never been more robust. From seltzers and hydration drinks to new forms of ready-to-drink coffee and tea, consumers would be hard-pressed not to find something they want the next time they are in front of the beverage case. With such a plethora of available options, we wanted to better understand the kinds of beverages consumers have been purchasing. We explored this in our latest wave of research-on-research.

Let’s see what we found:

Overall

Overall, sports drinks topped the list at 50%, making them the most commonly purchased item over the past 12 months. Ready-to-drink tea and coffee followed at 39% and 38%, while energy drinks reached 36%. Water flavor enhancers landed at 29%, with ready-to-drink protein shakes and electrolyte beverages trailing closely behind. These totals create a clear divide between mainstream hydration choices and specialized options that meet targeted needs.

Gender

When we looked at the data by gender, we uncovered some notable differences, especially in tea and sports drink purchases. Males reported higher purchase levels for both categories and showed slightly stronger engagement with protein powders and powdered milk. Females, meanwhile, were more likely to say they avoided all listed categories.

Age

There were some definite generational trends in beverage purchasing behavior. Interest in sports drinks and energy drinks shifted noticeably across generations. Sports drink purchases peaked with adults aged 35–44, while older adults 65+ showed the lowest levels. Energy drinks followed a sharper downward curve with age, especially those aged 35–44, showing the strongest activity. The shift across generations adds important context to how different age groups approach hydration and energy needs.

Other hydration categories, such as electrolyte drinks and coconut water, also revealed age-based shifts. Adults under 45 tended to purchase electrolyte products more often, while older respondents showed significantly lower engagement. Coconut water saw a similar pattern, with the highest interest among adults 25–44.

Income

Trends in functional beverages were highlighted when we broke the data down by income level. Higher-income groups consistently reported the strongest engagement with ready-to-drink coffee, energy drinks, and protein shakes. These categories climbed steadily with income, reaching their highest levels among respondents earning $100,000 or more.

Non-dairy milk and protein powders also moved upward across income levels. Lower-income respondents reported limited purchasing in these categories, while higher-income groups reached levels more than double those at the lowest income tier.

Region

Regional patterns showed subtle shifts, particularly in non-dairy milk and coconut water. The West led both categories, with the Northeast following at lower but still steady levels. Protein powders and powdered milk followed a similar pattern, again showing higher engagement in the West.

Ethnicity

Ethnicity introduced additional variation, especially in ready-to-drink coffee and energy drinks. Hispanic respondents reported the highest engagement with both categories, while Caucasian and Asian respondents showed more moderate levels. African American respondents reported lower activity overall, creating a noticeable contrast across groups.

Coconut water and electrolyte drinks also showed ethnic differences, with Asian respondents leading in coconut water and Hispanic respondents showing the highest electrolyte drink engagement.

Panel

Breaking the data down by panel source revealed sizable gaps, offering a clear view of how panel composition shapes results. Panel A consistently reported the highest levels across major categories, such as sports drinks, where it reached 64%. Panel L reported some of the lowest levels, including 40% for the same item, marking one of the largest differences between any two panels.

This really reinforces why you should be strategically blending sample. To learn more about strategic sample blending, click the button below.